Yesterday the New Jersey Business Coalition penned a letter to Assembly Speaker Coughlin encouraging amendments to the Assembly Bill No. 3999 and Senate Bill No. 2380 prior to tomorrow’s voting session in the Assembly. Read the letter here. The Greater Atlantic City Chamber sent a similar letter to members of the Assembly from Atlantic County. The intent of the legislation is to ensure that our essential employees who become ill receive the benefits they need. We believe that the goal can be met, without overwhelming and bankrupting the workers compensation system by making a few reasonable amendments to better tailor this legislation to those who may actually deserve the presumption established in the legislation.

What does S-2380 A-3999 do?

Under this legislation, any employee working at an “essential business” who develops COVID-19 is presumed to have caught the virus on the job and, therefore, eligible for all workers’ compensation benefits.

Shouldn’t essential employees who contract COVID-19 receive benefits if they got sick while working?

No one is disputing the need to provide benefits for workers who contract the virus as a result of their unique working conditions that made them more likely to contract COVID-19. Our concerns are 1) there are monies from the federal government that cover short-term needs that should be exhausted first; 2) the definition of “essential employee” is too broad; and 3) the presumption needs to end when stay-at-home orders are lifted and the presumption that an employee contracted the virus at work becomes less justifiable.

Shouldn’t first responders get special consideration for workers’ compensation?

First responders already receive special consideration for workers’ compensation benefits under the “Canzanella” legislation adopted last session. If fire, police, or medical workers develop COVID-19, they are already presumed to have contracted it on the job.

So who are the “essential employees” covered by the legislation? Front-line retail workers?

An essential employee is anyone working at a business deemed to be “essential” during the public health emergency, as declared by Executive Order 103 and extended by subsequent EOs. That includes the first responders already covered under Canzanella. It includes front-line retail workers in close contact with the public. And it also includes everyone else working at essential businesses, regardless of their interactions with the public or even other co-workers.

Isn’t it reasonable to assume that people with COVID-19 who are working outside the home probably caught the virus on the job?

Data (June 2020) from New York suggests no. Only 17% of hospitalized COVID patients have a job at all, 83% were either unemployed or retired. Front-line workers including nurses, police, and transit workers all show significantly lower infection rates than the population at large. And that’s just the early data, collected while most other activity is shut down. Restaurants are about to reopen, hair salons will open shortly thereafter. The validity of a presumption that a worker caught the virus on the job is already tenuous. As we move through phases two and three of the reopening, alternative sources of infection will continue to expand, and the legitimacy of that presumption will drop precipitously.

Does it matter? Don’t we need this legislation to ensure employees get income and medical coverage, regardless of where they were infected?

Actually, no. Employees can already file for New Jersey workers’ compensation, without the benefit of the legislation. And those who developed COVID-19 during existing stay-at-home conditions are likely to be successful, given the limited alternative sources of infection. As the economy reopens and employees have more interactions outside of the workplace, of course, the source of infection becomes far less certain and the presumption more determinative.

But workers’ compensation is not the only source of benefits for employees who cannot work due to COVID-19. Federally funded benefits are also available under the CARES Act.

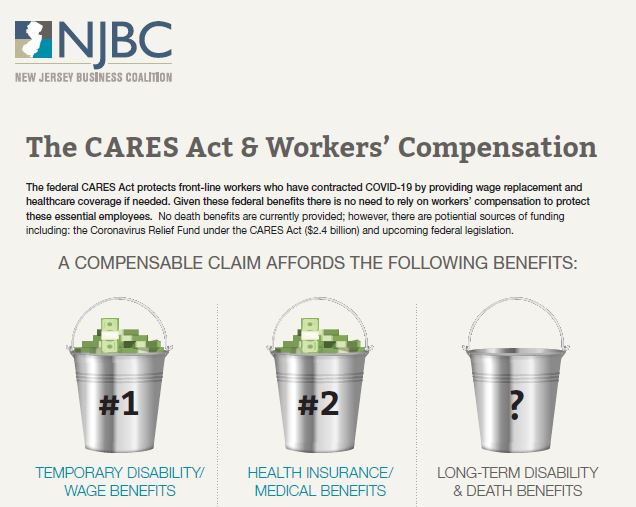

If an employee successfully files for workers’ compensation, what does he or she get?

Workers’ compensation meets the immediate needs of income replacement at 70% of salary and medical care. If necessary, it also provides permanent disability and death benefits.

What if he or she files for CARES Act federal benefits?

The CARES Act meets the immediate needs of income replacement at 60% salary through the PUA (Pandemic Unemployment Assistance) benefit, plus $600 supplemental per week through the FPUC (Federal Pandemic Unemployment Compensation) benefit. They are available for those unable to work due to COVID-19, even though the employee remains employed. The FPUC funding is currently authorized through July 31st and Congress is currently discussing terms for extending supplemental benefits. Federal benefits also cover all COVID-19 related medical expenses for anyone who lacks health insurance.

If the legislation only creates a shift in the presumption that employees with COVID-19 contracted the virus on the job – how does that impact federal funding?

If a worker seeks PUA funding, the benefit is fully funded by the federal government and no state resources funded by the employer community are needed to provide income replacement. An employee who lacks health insurance will also have all COVID-related medical expenses covered by the federal government. But an employee who seeks workers’ compensation will be disqualified from receiving those federal dollars. S-2380 creates a presumption that essential employees are eligible for New Jersey workers’ compensation – but those workers’ compensation benefits come at expense of other available federal benefits.

An employee who applies for PUA must list all other sources of income, including workers’ compensation, and PUA benefits are reduced by the amount of workers’ compensation received. Also, since the workers’ compensation will typically cancel out the full PUA benefit, that employee also becomes ineligible for the FPUC supplemental $600 per week, so both sources of federal dollars are forfeited.

What is the likely impact to the Workers’ Compensation Fund?

The Compensation Rating and Inspection Bureau (NJCRIB), an agency in the New Jersey Department of Banking and Insurance, is responsible for establishing and maintaining regulations and premium rates for workers’ compensation and employers’ liability insurance. It estimates a $400 million to $18 billion impact to the insured and self-insured markets. New York has decided against adopting similar legislation, due to similar projected costs, as well as the survey data indicating low levels of front-line worker exposure.

What about future needs for permanent disability or death benefits?

Congress is still considering additional programs which might meet those needs. But immediate needs are covered, and an employee infected today would have to wait at least six months to file for any permanent disability claims, so we can wait to see what happens at the federal level. If necessary, state legislation can target unmet needs – perhaps using some of the $2.4 billion New Jersey is already receiving to address COVID-19 expenses – without creating overlapping benefits that simply offset federal programs.

New Jersey Business Coalition Shift of Presumption for Workers Compensation Info Sheet Download

New Jersey Business Coalition The CARES Act & Workers’ Compensation